In our materialistic culture, it’s easy to be tempted by the allure of new and exciting products, especially as advertising becomes ever more targeted. Companies know more than ever about our personalities, lifestyles and buying habits, and promote products and services accordingly. This often leads to impulse buys which can result in budgets being stretched too thin. In fact, a CreditCards.com study found that 5 in 6 Americans make impulse buys, while 54 percent of those surveyed have spent $100 or more on something they didn’t plan to purchase.

Impulse buys don’t typically deliver beyond their initial appeal and their tendency to spiral us into debt creates more stress than satisfaction. Impulse spending is one of the biggest enemies of a healthy budget, but with a few tips, you can find the zen of shopping by quieting those urges, developing more enlightened shopping habits, and focusing more on the truly important things in life.

Don’t window shop. Window shopping, even when you’re not typically prone to impulse buying, baits you into spending needlessly. The easiest way to save money is to avoid this temptation altogether. After all, you can’t want what you don’t see! Visit only those stores that sell what you actually need and focus your attention on getting in and out as quickly as possible. For example, if you’re in a mall, concentrate on what you came for and skip wandering into stores you don’t need to visit. Think you’ll get too bored not spending money? Consult And Then We Saved’s list of 56 Things To Do Instead of Spending Money.

Understand need vs. want. This simple differentiation will be the most important skill you develop during your pursuit of mindful spending. When the temptation to buy something arises, ask yourself if you actually need it. “Needs” are simple; food, shelter, basic clothing and toiletries are all things we need. “Wants” are things we find interesting or engaging, but don’t actually require for survival. That new video game system, a $6 latte from Starbucks or that life-size replica of R2-D2 are all nice, but you don’t need them. When you’re faced with a decision while shopping, give yourself a minute to consider whether the object your scrutinizing has actual value in your life.

Avoid emotional shopping. The oft-used term of “retail therapy” carries the weight of unnecessary spending. Shopping under emotional stress or to celebrate a special occasion is common, but it makes you more vulnerable to impulse buying. If you’re feeling down or bored, try free activities or outings to boost your mood. If you’re celebrating something or treating yourself, invest in an experience or small treat instead of going on a shopping spree. Though shopping might make you feel better in the moment, it won’t provide sustainable happiness in the long run, especially when you’re broke and stressing about having low funds.

Beware of enablers. Shopping is typically a social occasion and often more fun to do with friends. Though there’s nothing wrong with having company when you shop, be aware of how other people impact your shopping habits. Everyone has those friends who advocate impulsive spending and use peer pressure to get you to buy things you don’t need. Just because your best friend insists you absolutely need that new t-shirt, the decision is ultimately yours. Try shopping alone or with someone who will talk you down from frivolous, unnecessary purchases. Better yet, challenge your friends to give up impulse buying as well, and make a pact to keep each other’s spending in check when you go out.

Sleep on it. Though instant gratification provides a rush of satisfaction, it is generally detrimental to your wallet. Make a spending rule for yourself: wait. If you see something you simply must have, force yourself to wait for a period of time. If something really sticks with you and you just can’t stop thinking about it, consider purchasing it, but again try to separate needs and wants before you buy. If you share finances with a significant other, consult with them about the purchase; doing so may result in their talking you out of an impulsive decision!

Shop around. Online shopping has made price comparison nearly effortless and an absolute must before you click “purchase.” While that French Press that’s been following you on social media may seem like a good price, conducting research gives you extra time to be more thoughtful about your purchase. In addition to a browser add-on like Invisible Hand, which alerts you when a better price exists for a product you’re looking at, always search for coupons before you checkout. Visit CouponSherpa.com for coupon codes to Kohl’s and other national stores, as well as discounts to niche sites that might be offering a better deal.

Only shop with cash or debit. The best mantra to avoid impulse buys: never spend what you don’t have. When you go shopping, pay with cash or a debit card instead of racking up your credit card bill. This way, you can only spend what you have and you’ll be more likely to pass up impulse items. Also avoid credit card sign-up offers, which merchants love to hound you with at checkout. Signing up for a new tool of temptation is not worth an extra 10 percent off your purchase.

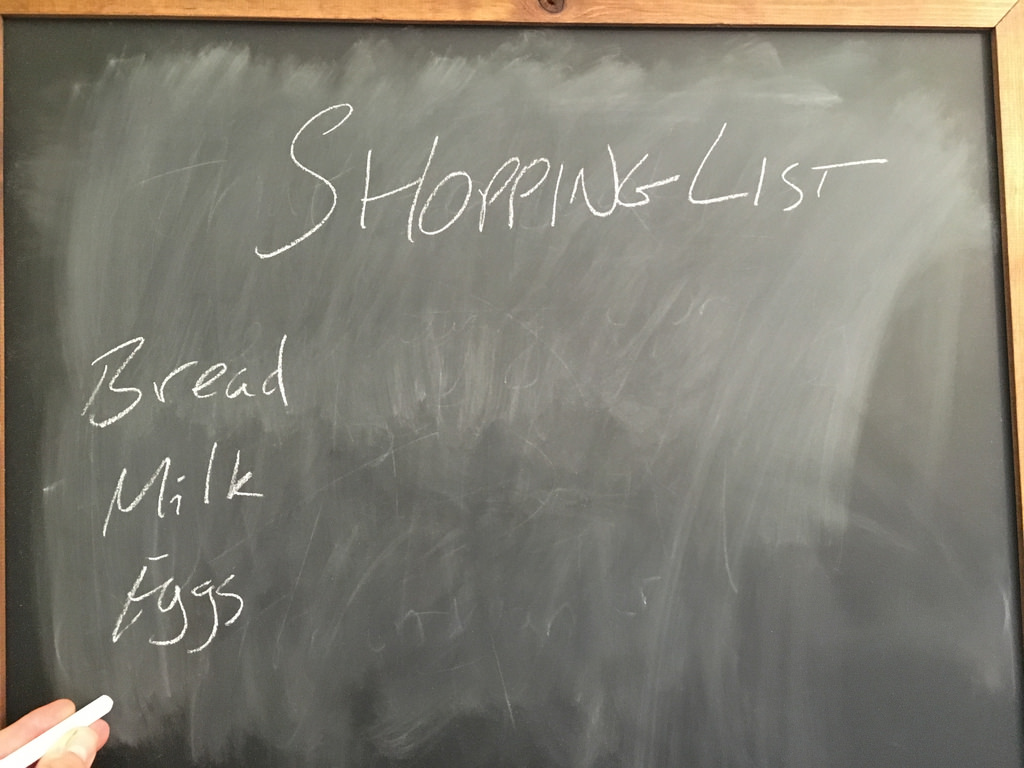

Make a list and plan your shopping. Even if you only need a few things, make a list before you go shopping. While most people make lists for groceries, they’re also useful for other purchases like clothing or home goods. A list makes you more focused and less likely to wander and buy more than you need. If an item is not on your list — and you don’t need it — skip it.

Don’t fall for low prices. You’ve completed your shopping, obtained everything on your list (and nothing extra), and you’re ready to check out. Then you see the discount rack, and everything is only $1 to $5! With prices this low, surely you can afford that decorative candle or cheap throw pillow. Though it seems like a harmless add-on, if you continue to impulsively spend $5 every time you shop, the expense adds up. Unless you know that something you need is located there, avoid these deal sections altogether.

Avoid 1-Click shopping. One of Amazon’s most popular features, 1-Click ordering, is a fast and convenient way to instantly make a purchase. This is probably the biggest impulse buying trap in online retail! If you use Amazon or other online stores, turn off expedited ordering and never save your credit card information to your computer. The extra moments and steps it takes to dig out and enter your credit card give you time to consider the necessity of your purchase.